In recent years, the funding landscape has seen a major shift, with many investors in search of alternative belongings to hedge in opposition to inflation and market volatility. One such alternative that has gained appreciable attention is the Gold Particular person Retirement Account (IRA). This observational research article delves into gold IRA reviews, exploring the sentiments, traits, and insights that emerge from consumer experiences and expert opinions.

Understanding Gold IRAs

A Gold IRA is a self-directed retirement account that permits people to put money into physical gold and other valuable metals. Unlike traditional IRAs, which sometimes embrace stocks, bonds, and mutual funds, Gold IRAs provide the chance to diversify retirement portfolios with tangible property. This diversification is more and more interesting to investors involved about financial instability and the long-time period worth of fiat currencies.

The Surge in Reputation

The popularity of Gold IRAs has surged in recent times, notably throughout periods of economic uncertainty. According to varied market reports, the demand trusted options for gold-backed ira rollover gold as a secure-haven asset has increased, resulting in a corresponding rise in the variety of best gold and silver ira IRA suppliers. As a result, many investors have turned to on-line platforms to share their experiences, resulting in a proliferation of gold IRA reviews.

Methodology of Observational Analysis

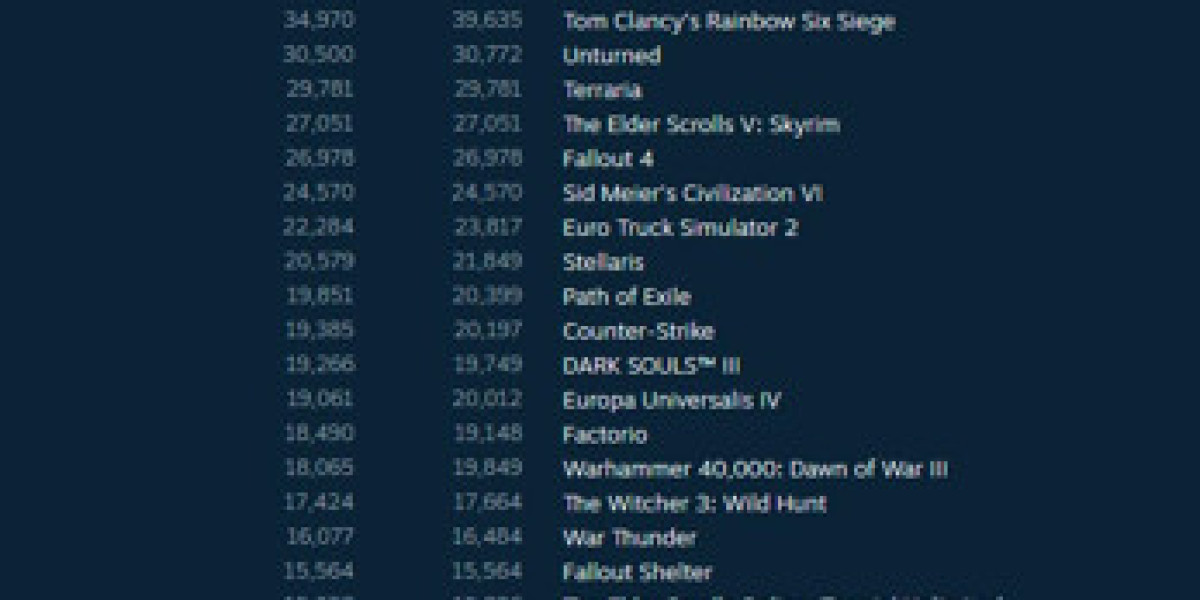

To assemble insights on gold IRA reviews, a complete analysis was conducted using on-line platforms resembling funding forums, overview web sites, and social media channels. The analysis targeted on identifying common themes, sentiments, and concerns expressed by users. A total of 500 evaluations had been analyzed, spanning numerous gold IRA companies and funding experiences.

Key Findings

- Investor Sentiment: Overall, the sentiment surrounding gold IRAs is predominantly optimistic. Many buyers specific satisfaction with their choice to diversify into gold, citing its stability and potential for lengthy-term progress. Positive reviews usually spotlight the safety that gold gives, particularly throughout economic downturns.

- Customer support: A recurring theme in the evaluations is the importance of customer support. Traders incessantly point out their interactions with gold IRA suppliers, noting that responsive and educated buyer assist considerably enhances their investment experience. Firms that prioritize transparency and education are likely to obtain greater ratings.

- Fees and Costs: One of the mentioned matters in gold IRA reviews is the fee construction associated with these accounts. Many traders express concerns about the varied fees, including setup fees, storage fees, and transaction charges. Reviews point out that potential investors should totally analysis and examine fee structures earlier than committing to a selected provider.

- Academic Assets: A notable trend is the emphasis on instructional resources supplied by gold IRA companies. Traders recognize companies that provide complete guides, webinars, and personalized advice. Opinions indicate that educational sources can empower investors to make informed selections about their gold investments.

- Funding Efficiency: While many reviews highlight the perceived stability of gold, some investors categorical considerations concerning the short-term volatility of gold costs. It's common to see critiques that talk about the importance of an extended-time period perspective when investing in gold, emphasizing that fluctuations mustn't deter investors from their total strategy.

- Regulatory Compliance: Compliance with IRS rules is a essential side of gold IRAs. Reviews usually point out the significance of choosing a reputable provider that adheres to regulatory requirements. Buyers categorical a desire for transparency relating to the legitimacy of the gold being bought and the storage amenities used.

- Comparability with Different Investments: Many opinions mirror a comparative analysis between gold IRAs and other funding autos, akin to stocks or actual property. Investors often focus on the advantages of gold as a hedge in opposition to inflation, contrasting it with the volatility of the inventory market. This perspective is particularly prevalent among these who have experienced market downturns.

Challenges and Concerns

Regardless of the overall optimistic sentiment, there are challenges and considerations that potential traders ought to bear in mind of. Some reviews highlight issues equivalent to:

- Scams and Fraud: A portion of evaluations warns potential buyers about scams and fraudulent firms. In the event you liked this informative article and you desire to get more information about reliable ira for precious metals generously stop by our own web-page. Customers emphasize the need recommended options for ira rollover in precious metals investments thorough research and due diligence earlier than choosing a gold IRA supplier.

- Market Timing: Several buyers specific issues in regards to the timing of their gold purchases. Some critiques point out that individuals who invested throughout market highs experienced regret when costs subsequently fell. This highlights the importance of strategic planning and market analysis.

- Bodily Storage: The logistics of storing bodily gold is one other concern mentioned in opinions. Buyers typically talk about the significance of safe storage choices and the related prices, which might affect total returns.

Conclusion

The observational research on gold IRA reviews reveals a fancy panorama of investor sentiment, issues, and experiences. Whereas the overall outlook is optimistic, with many traders appreciating the stability and potential of gold as an investment, challenges similar to charges, customer service, and market volatility stay prevalent.

As the demand for reliable gold ira providers IRAs continues to grow, it is crucial for potential investors to conduct thorough analysis, educate themselves on the intricacies of gold investing, and select reputable providers. By understanding the insights gleaned from gold IRA reviews, people could make knowledgeable decisions that align with their monetary targets and retirement strategies.

In summary, gold IRAs symbolize a viable different funding possibility, particularly for those seeking to mitigate dangers associated with conventional markets. As the landscape evolves, ongoing observational analysis will probably be essential in offering useful insights to each present and prospective traders within the gold IRA area.