In recent years, the panorama of retirement investing has undergone a significant transformation, significantly with the emergence of low-fee gold ira and silver IRA companies. These firms have introduced modern options that cater to the growing demand for different belongings in retirement accounts, allowing investors to diversify their portfolios past conventional stocks and bonds. This text explores the demonstrable advances made by gold and silver IRA companies, focusing on their companies, know-how integration, and regulatory compliance.

One of the notable advancements within the gold and silver IRA sector is the increased accessibility of precious metals for retirement financial savings. Corporations like Goldco, Augusta Precious Metals, and Birch Gold Group have streamlined the process of setting up a self-directed IRA that includes bodily gold and silver. They supply instructional assets, personalized consultations, and person-friendly platforms that empower traders to make informed choices. This accessibility is crucial, because it enables a broader demographic to think about precious metals as a viable possibility for retirement planning.

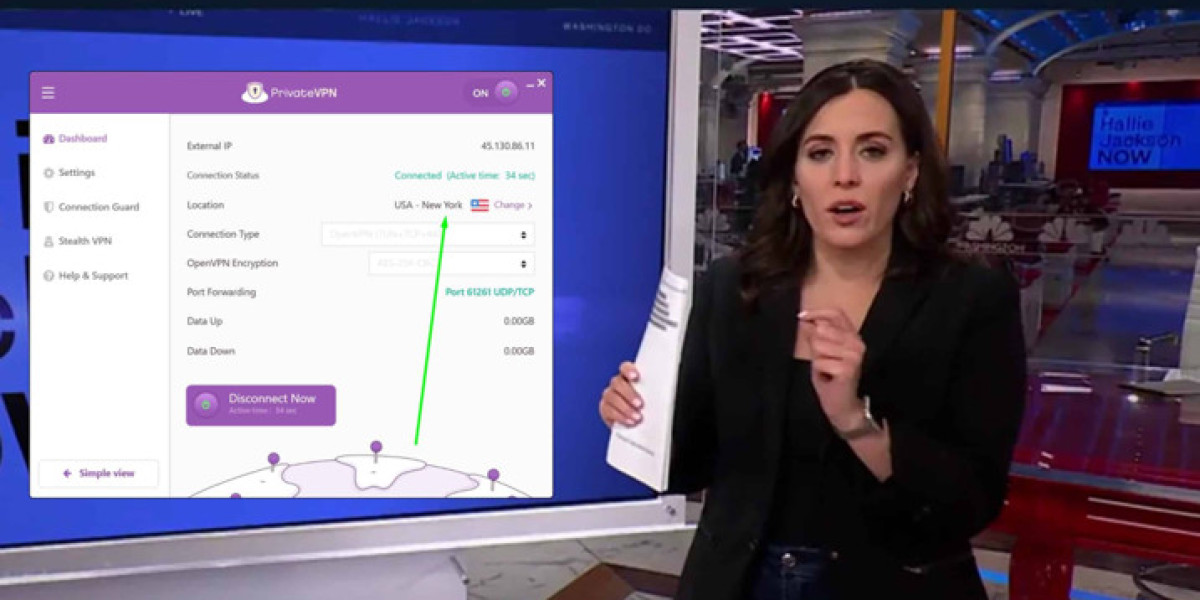

Additionally, the combination of expertise has revolutionized how gold and silver IRA companies function. Many corporations now provide online platforms that allow traders to manage their accounts seamlessly. These platforms present actual-time pricing, stock tracking, and transaction historical past, making it easier for people to watch their investments. As an example, corporations like Noble Gold Investments have developed cellular functions that allow purchasers to access their accounts on-the-go, enhancing person experience and engagement.

One other important advancement is the introduction of enhanced security measures to protect traders' property. Gold and silver IRA companies have recognized the importance of safeguarding physical metals, and lots of have partnered with reputable custodians and storage services. If you liked this write-up and you would certainly such as to receive more information pertaining to secure options for ira precious metals rollover kindly browse through the webpage. These custodians supply safe vaulting choices which can be insured and monitored, making certain that shoppers' investments are protected from theft or harm. Moreover, some corporations provide insurance policies that cover the value of the metals held in their shoppers' IRAs, adding an additional layer of security that was not as prevalent previously.

Furthermore, gold and silver IRA companies have made strides in regulatory compliance, which is essential for building trust and credibility with investors. The internal Revenue Service (IRS) has specific guidelines relating to the kinds of treasured metals that may be included in a retirement account. Respected companies have taken proactive steps to make sure that their offerings comply with these laws. They provide clear guidelines on eligible metals, including gold and silver coins and bullion that meet the minimum purity standards set by the IRS. This transparency helps buyers keep away from potential pitfalls and ensures that their investments are compliant with tax regulations.

One other area of development is the customization of investment secure options for ira precious metals rollover. Many gold and silver IRA companies now provide a wide range of merchandise that cater to totally different investor preferences. For example, shoppers can choose from a range of gold and silver coins, bars, and rounds, as well as various packaging trusted options for gold ira. This flexibility allows traders to tailor their portfolios to align with their financial targets and threat tolerance. Moreover, some companies provide pre-packaged funding kits that embody a selection of fashionable gold and silver merchandise, simplifying the shopping for course of for many who could also be new to precious metals investing.

Furthermore, the academic initiatives launched by gold and silver IRA companies have significantly improved investor knowledge and confidence. Many companies present webinars, articles, and guides that cover varied elements of investing in treasured metals, including market traits, historic efficiency, and the benefits of diversification. This concentrate on training empowers traders to make knowledgeable decisions and perceive the potential role of gold and silver in their overall retirement strategy.

In recent years, the growth of socially responsible investing has also influenced the offerings of gold and silver IRA companies. Some companies have begun to source their metals from ethical and environmentally accountable suppliers, catering to traders who prioritize sustainability. This shift displays a broader pattern in the funding panorama, where consumers are increasingly searching for to align their monetary decisions with their values. Firms that embrace these ideas not only attract socially acutely aware investors but in addition contribute to a extra sustainable future for the precious metals trade.

The competitive panorama of gold and silver IRA companies has also driven advancements in customer service. Many corporations now prioritize customer satisfaction by offering devoted support groups, customized consultations, and clear fee constructions. This dedication to service excellence enhances the overall consumer expertise and fosters long-time period relationships between investors and their chosen companies. As the trade continues to evolve, corporations that prioritize customer support will seemingly stand out in a crowded market.

Finally, the rise of digital assets has prompted gold and silver IRA companies to explore new avenues for investment. Some corporations have begun to combine cryptocurrency choices into their offerings, allowing purchasers to diversify their portfolios further. This innovation reflects the changing nature of investing and the need for companies to adapt to emerging tendencies. By offering access to each conventional treasured metals and digital property, these firms place themselves as forward-pondering leaders in the retirement funding area.

In conclusion, the advancements made by gold and silver IRA companies have significantly transformed the best way buyers method retirement planning. Via enhanced accessibility, technological integration, improved security measures, regulatory compliance, personalized funding options, academic initiatives, and a concentrate on customer service, these corporations are paving the best way for a brand new period of funding alternatives. Because the demand for alternative assets continues to grow, gold and silver IRA companies are effectively-positioned to fulfill the evolving needs of buyers and assist them build a safe financial future. The innovations within this sector not only improve the investment expertise but also contribute to a extra strong and diversified retirement strategy, guaranteeing that valuable metals stay a beneficial part of long-term financial planning.